Will the Improving Real Estate Market Spark Another Insurance Ad War?

Property insurance advertising is started to increase and gain greater importance. According to Kantar Media research, media spending for personal property insurance ads hit $118 million for the period from January to October 2012. This was more than double the amount spent in the segment in the prior year. That figure is expected to jump sharply after the devastation from Hurricane Sandy, which led major insurance companies to run ads targeted toward the storm’s victims. In addition, the housing market has shown signs of improvement, which should spur ad development even faster and further. AdAge.com recently offered a closer look at all of the factors figuring into the influx of insurance ads.

While spending on property insurance ads is still substantially less than the ad spend on auto insurance, companies that offer a variety of insurance products have started to adjust their ad budgets to allot more money toward the promotion of property insurance.

Home construction is also on the rise, according to Bob Hartwig, president of the Insurance Information Institute. “Each and every new home that is constructed is going to be insured, and that’s a new property for the industry to compete over.”

Companies like Progressive and Geico established an early ad presence with their memorable property insurance advertising campaigns. Now, they’re focusing even more attention on the property segment by bundling it with their other insurance products for greater consumer convenience and to keep their competitors at bay. Other insurers that hadn’t been so promotionally proactive have realized that they need to catch up in order to claim some of the remaining market share.

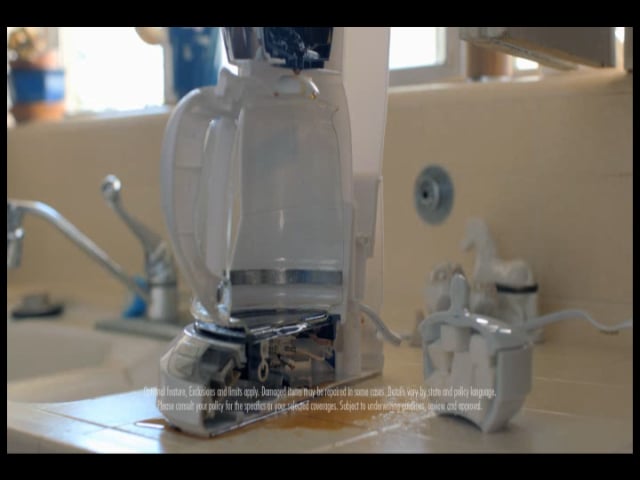

One example of a latecomer-turned-competitor is Nationwide Insurance. The company plans to allot about half of its Q1 ad spend toward homeowner, condo, and tenant policies. The main ad in the TV campaign will feature a policy that reimburses for the full cost to replace destroyed or stolen property, instead of only compensating for the depreciated value. Nationwide has long offered this particular policy, and even though it calls for higher premiums and is similar to options offered by other insurers, this is the first time that the company is promoting this kind of policy. Nationwide has also rebranded this policy as “Brand New Belongings” instead of simply referring to it as “extended replacement costs coverage.”

This particular ad is part of the company’s larger “Join the Nation” campaign. Rather than reverting to the ridiculous humor or edgier antics that other insurers have commonly used in their ad campaigns, Nationwide’s TV commercials will incorporate sly wit with visual effects and be narrated by actress Julia Roberts.

Interestingly, Nationwide is also changing the way it discusses its products. The company’s prior ad campaigns featured a general security message that ultimately drove consumers to its competitors. Now, the company has chosen to highlight a specific property insurance policy since they have found this approach to be much more effective in driving their message home.

To learn more about the power of creative TV commercials, contact MDG today at 561-338-7797 or visit www.mdgsolutions.com.

MDG, a full-service advertising agency with offices in Boca Raton and New York, NY, is one of Florida’s top integrated marketing agencies. Our 360° approach uses just the right mix of traditional and digital marketing to reach your advertising goals. While some industries may fare better in print or TV advertising, and others online, we strive to create a balanced approach, where traditional and digital marketing efforts support each other and your message is tailored to the medium. To learn more about the latest trends in marketing and advertising, contact MDG today at 561-338-7797 or visit www.mdgsolutions.com.

Read more at Adage.com.